S corp tax calculator

Corporations other than banks and financials. Web Nearby Recently Sold Homes.

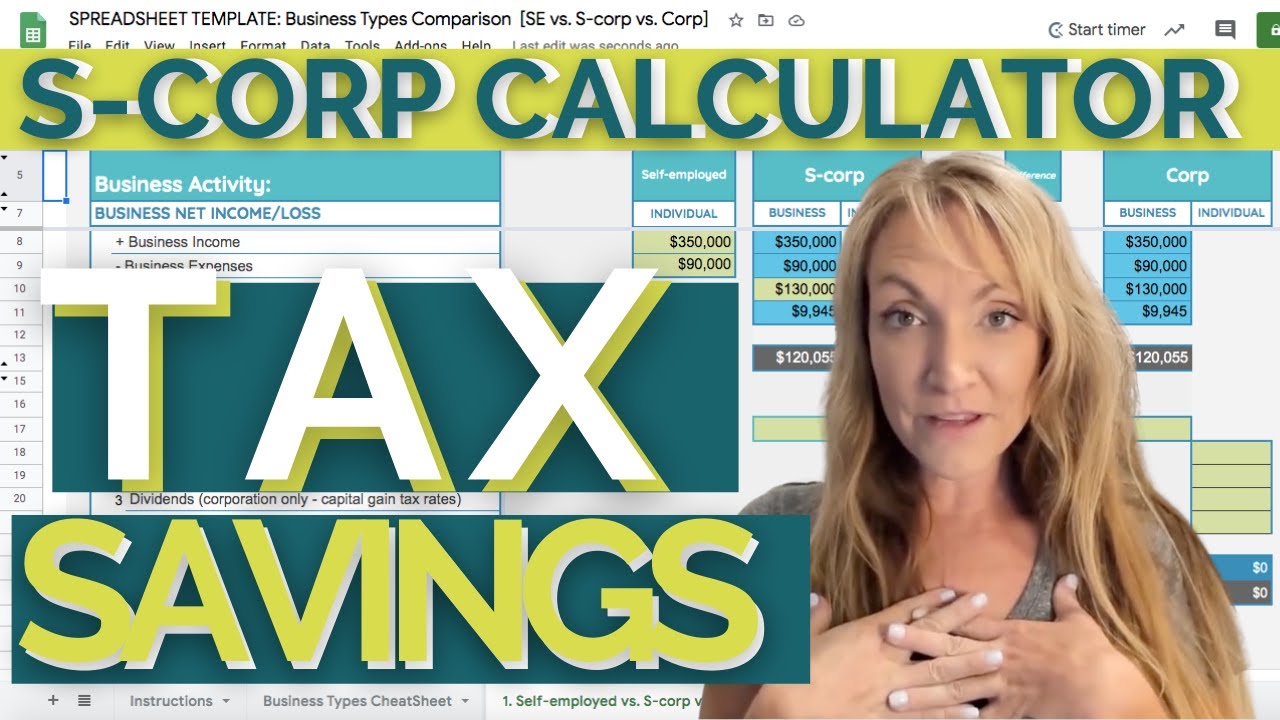

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Lets do this together.

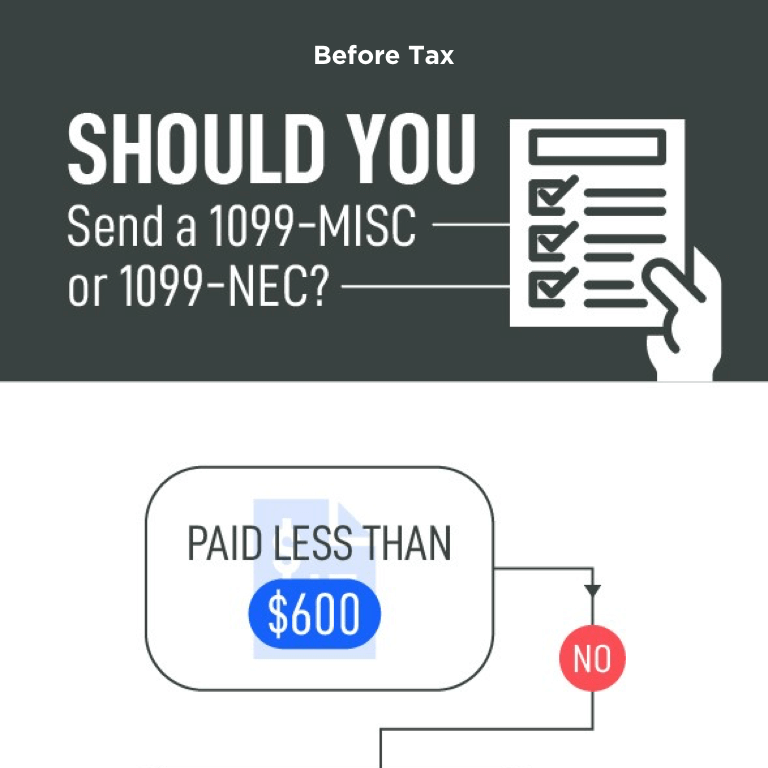

. Web I created this S corp tax savings calculator to give you a place to start. Discover your tax savings by becoming an S Corp in your state. Web S pringmeyer Law is a corporate transactions and intellectual property law firm for startups and investors in software hardware and other tech ventures.

Web Therefore an S corporation with a net income of 1 million owes 15 of that or 15000 in California state income tax. Ad 2M customers have trusted us with their business formations. Web This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps.

We serve clients in San. Discover The Answers You Need Here. Web S-Corp Business Filing And Calculator - Taxhub S-Corp Calculator Calculating Your S-Corp Tax Savings is as Easy as 1-2-3.

Web As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Web Aug 18 2022 S Corp Tax Calculator - LLC vs C Corp vs S Corp LLC vs S Corp free zero sign up tax dashboard. Web Cost Per Mile CPM Calculator.

Were ready when you are. Start your corporation with us. Your household income location filing status and number of.

Web As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Day Sales Outstanding DSO Calculator. Web Nearby homes similar to 4708 S San Pedro St have recently sold between 518K to 855K at an average of 360 per square foot.

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. As youre running through the calculations above be sure to talk to a financial pro to help you. Web The s corp tax calculator.

Earned Value Management EVM Calculator. But as an S corporation you would only owe self-employment tax on. Web Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Just complete the fields below with your best estimates. Web You can use an S corporation tax calculator to calculate how much income you take as a salary how much income is spent as a distribution and how this affects. The business income then passes through to.

Nearby homes similar to 2620 S Budlong Ave have recently sold between 615K to 1580K at an average of 460 per square foot. Days Inventory Outstanding DIO Calculator. For example if your one-person S corporation makes 200000 in profit.

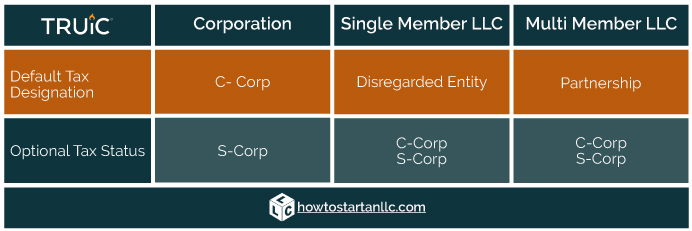

This tax calculator shows these values at the top of. Get started on yours today. Web S-Corp VS Sole Prop Calculator Other considerations when choosing an entity LLC Limited Liability Company Its important to note that an LLC is not a taxing or filing entity.

If you want to take advantage of these tax rules you can either form an s corporation or. Alternative Minimum Tax AMT rate. SOLD APR 18 2022.

650000 Last Sold Price.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

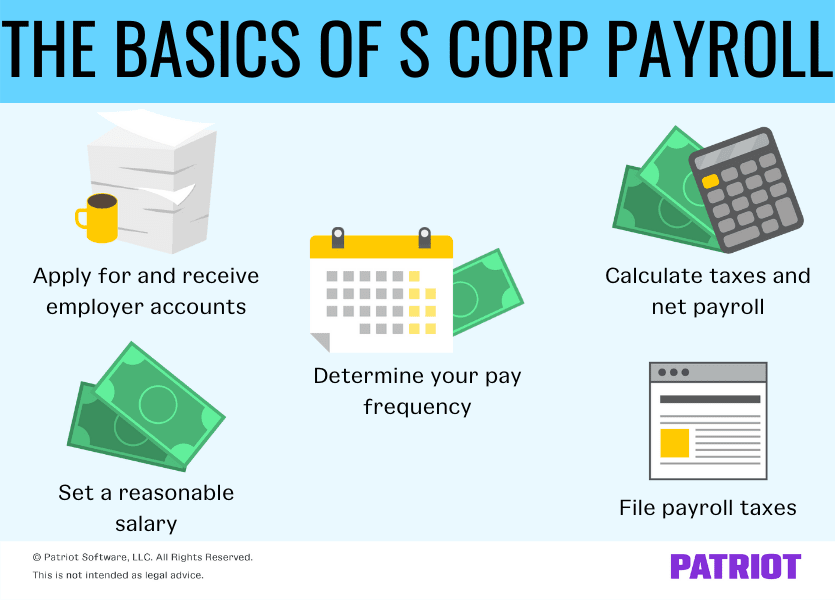

S Corp Payroll Taxes Requirements How To Calculate More

Determining The Taxability Of S Corporation Distributions Part I

S Corporation Tax Calculator

Calculating Basis In Debt

S Corporation Tax Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corporation Tax Calculator

Calculating Basis In Debt

The Basics Of S Corporation Stock Basis

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator

S Corp What Is An S Corporation Subchapter S

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate